In a global company with about 100 UX researchers and designers (!!!), I've been particularly lucky to work in a role where I was sent out to lead design on project teams all around the massive finance business.

I worked on consumer-facing products including online Home Loan tools and high-tech ATMs, plus the internal software platform design.

My part: UX, UI, VD, design leadership.

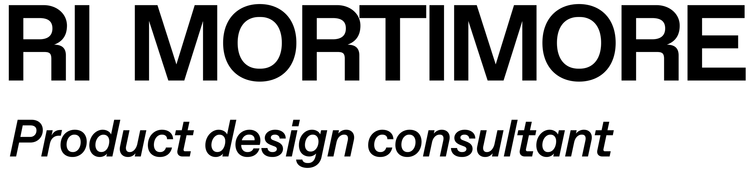

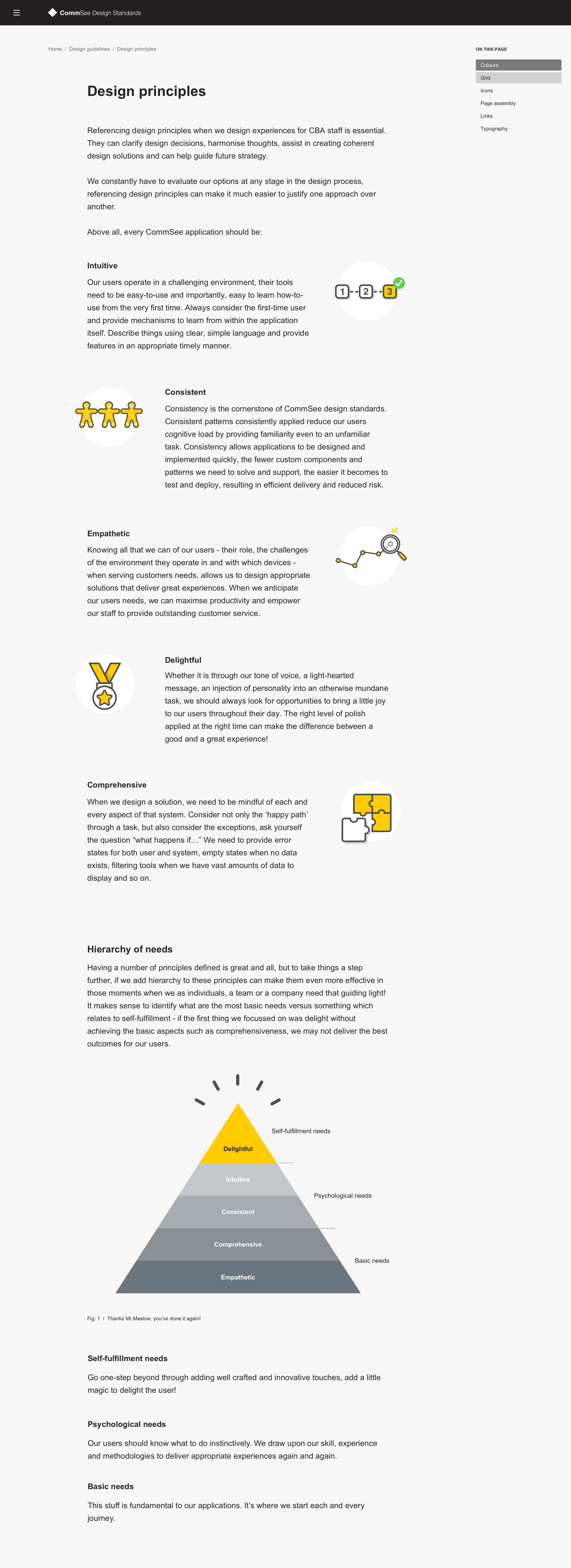

In this role, I made a comprehensive experience design system as part of the global design system. Here you can see the Design Principles I wrote after six months of user research and testing.

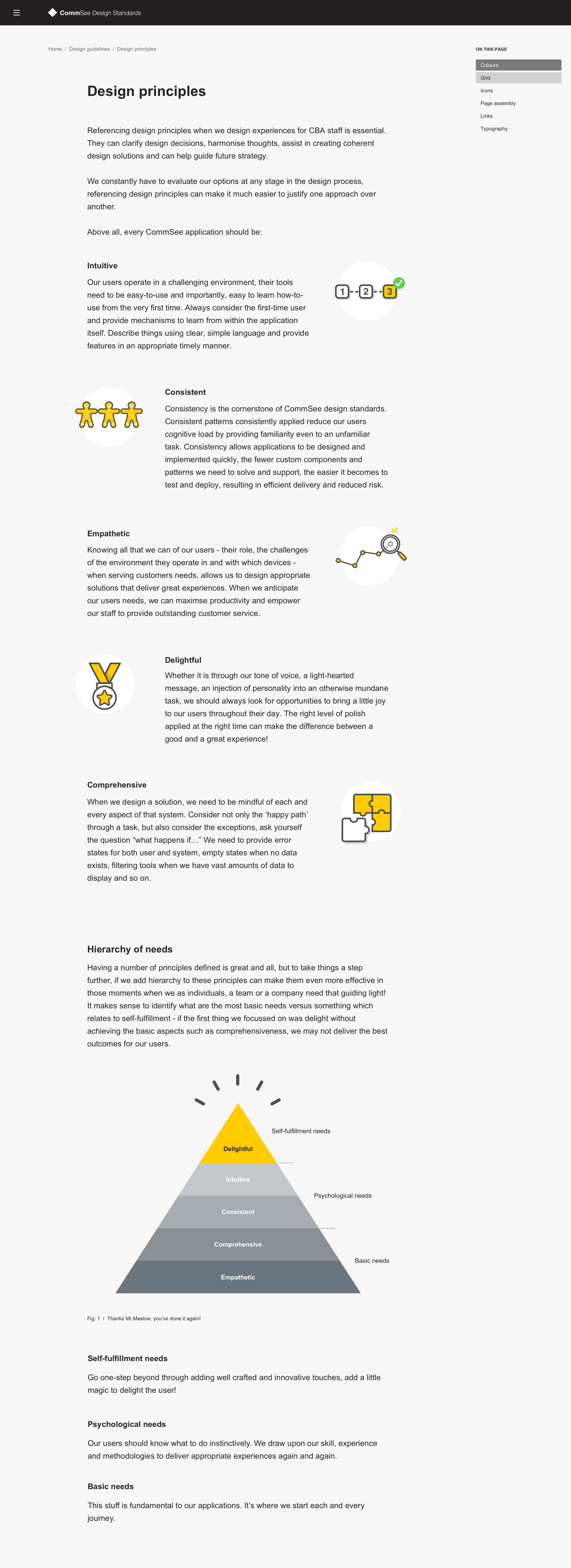

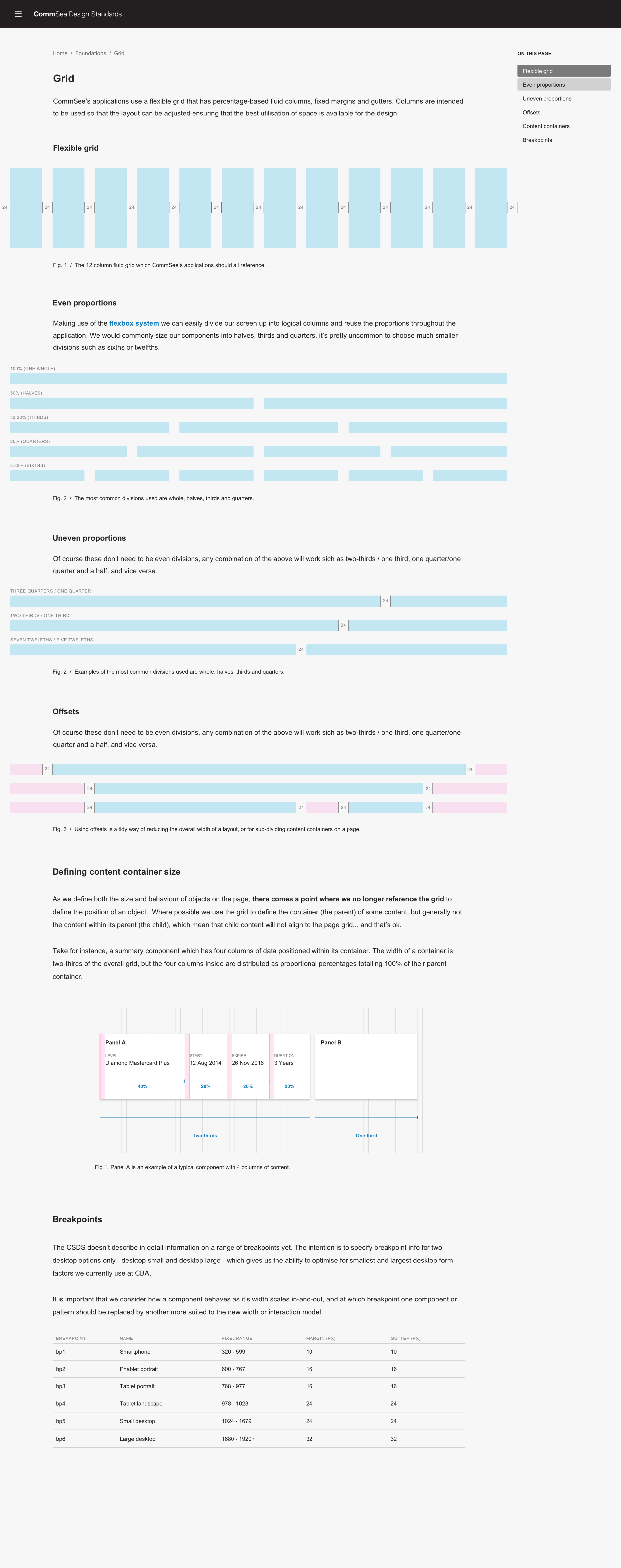

… And here you’ll see the gridding guide I created for the platform.

At Commonwealth, the bar was very high for designers to be strong right across UX, UI and visual design.

On all of my projects, I delivered polished final visual assets, style guides and prototypes, plus some animation, illustration and logo design.

I prototyped using whatever means necessary - this included Axure, Pixate, Framer.js, Invision and more.

I had fantastic research resources including labs and usability testing hardware in this role. I took a design thinking approach on all of my projects - constantly designing -> testing with real customers and staff -> iterating.

I was lucky to work on the most recent interfaces for these cutting-edge ATMs!

I created prototypes for depositing cheques and cash, and prototyped audio loops for hearing impaired customers.

I often prototyped delightful animations and microinteractions to be used in app.

I picked up a unique skill set in this role, in what I like to call 'responsible designing'.

Being a bank, the legal and compliance requirements were enormous, and this actually fed through to my design decisions. I had to ensure that my designs encouraged responsible use of financial products by both staff and customers. This was a fascinating aspect of UX design to explore.

Iconography and illustration was a new challenge for me. I helped to define some of the standard icons now in use across web and apps.

To create banking products, I needed to first understand the way customers experience the bank's services. This discovery took me to bank branches, call centers, financial advisors offices and more.

These customer journeys were often incredibly complicated, and I often sorted this information by creating experience maps, mental models, storyboards and user flows.

Lots of user flows.

In a global company with about 100 UX researchers and designers (!!!), I've been particularly lucky to work in a role where I was sent out to lead design on project teams all around the massive finance business.

I worked on consumer-facing products including online Home Loan tools and high-tech ATMs, plus the internal software platform design.

My part: UX, UI, VD, design leadership.

In this role, I made a comprehensive experience design system as part of the global design system. Here you can see the Design Principles I wrote after six months of user research and testing.

… And here you’ll see the gridding guide I created for the platform.

At Commonwealth, the bar was very high for designers to be strong right across UX, UI and visual design.

On all of my projects, I delivered polished final visual assets, style guides and prototypes, plus some animation, illustration and logo design.

I prototyped using whatever means necessary - this included Axure, Pixate, Framer.js, Invision and more.

I had fantastic research resources including labs and usability testing hardware in this role. I took a design thinking approach on all of my projects - constantly designing -> testing with real customers and staff -> iterating.

I was lucky to work on the most recent interfaces for these cutting-edge ATMs!

I created prototypes for depositing cheques and cash, and prototyped audio loops for hearing impaired customers.

I often prototyped delightful animations and microinteractions to be used in app.

I picked up a unique skill set in this role, in what I like to call 'responsible designing'.

Being a bank, the legal and compliance requirements were enormous, and this actually fed through to my design decisions. I had to ensure that my designs encouraged responsible use of financial products by both staff and customers. This was a fascinating aspect of UX design to explore.

Iconography and illustration was a new challenge for me. I helped to define some of the standard icons now in use across web and apps.

To create banking products, I needed to first understand the way customers experience the bank's services. This discovery took me to bank branches, call centers, financial advisors offices and more.

These customer journeys were often incredibly complicated, and I often sorted this information by creating experience maps, mental models, storyboards and user flows.

Lots of user flows.